Mortgage Insurance Premiums Deduction Worksheet

You cant deduct your mortgage insurance premiums if the amount on Form 1040 line 38 is more than 109000 54500 if married filing separately. Deductions Form 1040 Itemized.

Rental Property Tax Deductions Rental Property Management Real Estate Investing Rental Property House Rental

Mortgage insurance premiums deduction worksheet 2017.

Mortgage Insurance Premiums Deduction Worksheet. Enter the total premiums the estate or trust paid in 2009 for qualified mortgage insurance for a contract issued. If the amount on Form 1040 line 38 is more than 100000 50000 if married filing separately your deduction is limited and you must use the Mortgage Insurance Premiums Deduction Worksheet to figure your deduction. Treat all the mortgage insurance premiums you paid under a mortgage insurance contract issued after December 31 2006 in connection with home acquisition debt that was secured by your first or second home as a personal expense and complete a separate Mortgage Insurance Premiums Deduction Worksheet in the Instructions for Schedule A for Form 8829.

See line 8d in the Instructions for Schedule A Form 1040 or 1040-SR and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. 2019 Qualified Mortgage Insurance Premiums Deduction Worksheet Qualified Mortgage Insurance Premiums Premiums that you pay or accrue for qualified mortgage i nce during 2017 in connection with home acquisition debt on your qualified home are deductible as. The insurance was obtained.

You could of course imagine about setting them. Medical or dental insurance premiums for any person for whom you may claim a deduction for such premiums under federal income tax laws. Medical and dental insurance premiums paid to insurer by taxpayer or spouse exclude.

Best Mortgage Insurance Premiums Deduction Worksheet FREE Printable Worksheets. Per IRS Publication 936 Home Mortgage Interest Deduction page 8. Of your Adjusted Gross Income for Tax Year 2020 and are not reimbursedpaid by insurance.

Mortgage Insurance Premiums Enter the qualified mortgage insurance premiums you paid under a mortgage insurance. Qualified mortgage insurance is mortgage insurance provided by the Veterans Administration the Federal Housing Administration or the Rural Housing Administration and private mortgage insurance. If your adjusted gross income is more than 109000 54500 if married filing separately you.

Prepaid 2018 real estate and personal property taxes. Form 1098 Mortgage Interest Statement. Mortgage insurance premiumsThe deduction for mortgage insurance premi-ums has been extended through 2017.

See line 8d in the Instructions for Schedule A Form 1040 and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. Publication 936 2020 Home Mortgage Interest Deduction. Limits on Home Mortgage Interest Deduction.

You can claim the deduction on line 8d of Schedule A Form 1040 for amounts that were paid or accrued in 2020. Limit on amount. Deductible only to the extent they exceed 75.

This deduction has been retroactively extended back to 2018 and through 2020. Home equity loan interest. Premium paid by homeowners on mortgage insurance for FHA loans that can be deducted in the same manner as home.

Mortgage insurance premiums you paid or accrued on any mortgage insurance contract issued before January 1 2007 are not deductible. The insurance must be in connection with home acquisition debt and the insurance contract must have been issued after 2006. Mortgage insurance during 2019 in connection with home acquisition debt on your qualified home are deductible as home mortgage insurance premiums.

Qualified Mortgage Insurance Premium. To have your mortgage insurance premium deduction qualify. Mortgage Insurance Premiums You can treat amounts you paid during 2014 for qualified mortgage insurance as home mortgage interest.

Form 1098 Mortgage Interest Statement. Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 a month or so at a 05 rate on a 200000 mortgage. However in 2006 Congress made these payments tax-deductible to help reduce the burden of these costs.

For taxpayers filing Form N-11 the deduction for mortgage interest premiums and other deductible interest will be added together in Worksheet A-3 in the 2020 Form N-11 Instructions and reported on Form N-11 line 21c. Deducting home mortgage interest. Mortgage insurance premiums deduction worksheet.

Self-Employed Health Insurance Deduction Worksheet - When it comes to you wanting to arranged goals for yourself right now there are several ways in which this can be done. Insurance Irsgov Get All. If the amount is more than 100000 50000 if Married Filing Separately your deduction is limited and you must use the worksheet to figure your deduction.

But see Limit on long-term care premiums you can deduct later. Limits on Home Mortgage Interest Deduction. If your 2018 state and local real estate or personal property tax-es were assessed and paid in.

You cant deduct insurance premiums paid by. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 Form 1040 line 16. The reason the Qualified Mortgage Insurance Premium isnt being allowed is because of the limit on the amount you can deduct.

You can claim the deduction on Line 13 for amounts that were paid or accrued in 2017. Prepaid 2018 real estate and personal property taxes. Enter the total premiums the estate or trust paid in 2009 for qualified mortgage insurance for a contract issued.

Qualified mortgage insurance is mortgage insurance provided by the Veterans Administrationthe Federal Housing Administration or the Rural Housing Administration and private mortgage insurance. 2018 Qualified Mortgage Insurance Premiums Deduction Worksheet Qualified Mortgage Insurance Premiums Premiums that you pay or accrue for qualified mortgage i nce during 2017 in connection with home acquisition debt on your qualified home are deductible as. The deduction for mortgage insurance premi-ums has been extended through 2017.

However when purchasing a home other costs can quickly accumulate. Medicare reported on an SSA-1099. Mortgage insurance premiumsThe itemized deduction for mortgage insurance premiums has been extended through 2020.

Special Rule for Tenant-Stockholders in Cooperative Housing Corporations. Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest. If you paid premiums for mortgage insurance in 2018 or were amortizing prepaid mortgage insurance premiums from an earlier years home purchase you may be able to amend your 2018 return for a tax refund.

Mortgage insurance premium deduction worksheet. And dental care including premiums for qualified long-term care insurance con-tracts as defined in Pub. Special Rule for Tenant-Stockholders in Cooperative Housing Corporations.

You can claim the deduction on Line 13 for amounts that were paid or accrued in 2017. The tax deduction was scheduled to last through the 2016 tax year but it has been extended through at least 2020. 2017 federal Schedule A instructions for lines 10 11.

Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest. But the tax is deductible only up to the Qualified Mortgage Insurance Premiums Deduction Worksheet Keep for Your Records 1. The limit is 109000 54500 if Married Filing Separately.

Publication 530 2014 Tax Information For Homeowners Business Budget Template Business Tax Deductions Tax Deductions

5 Free Rental Property Expenses Spreadsheets Excel Tmp Being A Landlord Rental Property Management Rental Property

Rental Property Tax Deduction Template Rental Property Management Property Management Rental Property

Dependent Care Fsa We All Spend Time On Finding Ways To Make Money And Invest But Finding Ways To Keep Wh After School Care Way To Make Money Personal Finance

Employee Annual Leave Record Sheet Templates 7 Free Docs Xlsx Pdf Schedule Template Excel Calendar Template Calendar Template

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Tax Deductions Deduction

Mortgage Refinance Calculator Excel Spreadsheet Mortgage Refinance Calculator Refinance Mortgage Refinance Calculator

Construction Kpis Dasboard Mohamed Elsaadany Pmp Ccp Pmi Rmp Sce Pe Pulse Linkedin Future Plans How To Plan Fails

Itemized Tax Deduction Worksheet In 2021 Tax Deductions Small Business Expenses Deduction

Philhealth 101 Sample Philhealth Request Letter Lettering Letter Sample Color Worksheets For Preschool

Lead Tracking Sheet Followup Worksheet For All Your Leads Printable Page Business Development Form Small Business Pdf Instant Download Business Development Getting Things Done Lead Sheet

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Time Management Worksheet Payroll

Capability Statement Template Doc New Capability Statement Template 12 Free Pdf Word Statement Template Quote Template Sample Proposal Letter

Debt Consolidation Spreadsheet In 2021 Paying Off Credit Cards Debt Debt Consolidation

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Profit Loss Statement Example Awesome Printable Blank Profit And Loss Statement Profit And Loss Statement Statement Template Sponsorship Form Template

Home Budget Template Budget Template Excel Budget Template Excel To Help You Managing Excel Budget Template Household Budget Template Home Budget Template

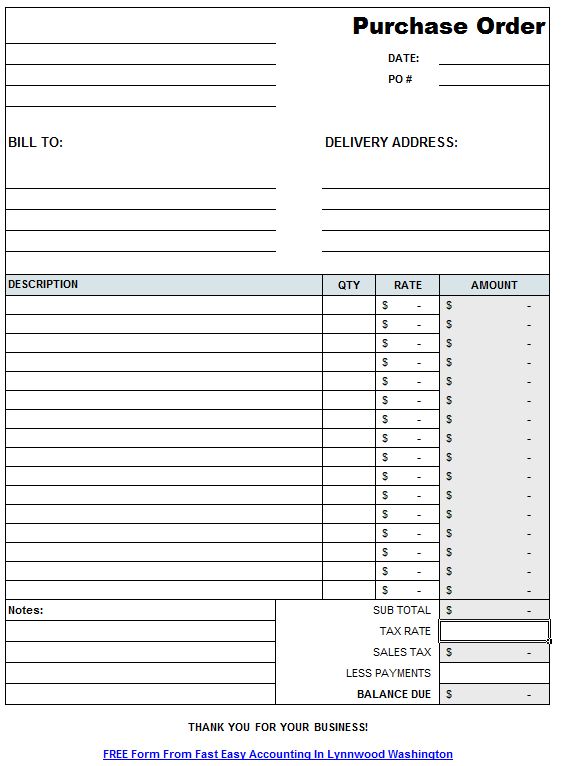

Free Contractor Purchase Order Template Excel Purchase Order Template Purchase Order Form Purchase Order

Posting Komentar untuk "Mortgage Insurance Premiums Deduction Worksheet"